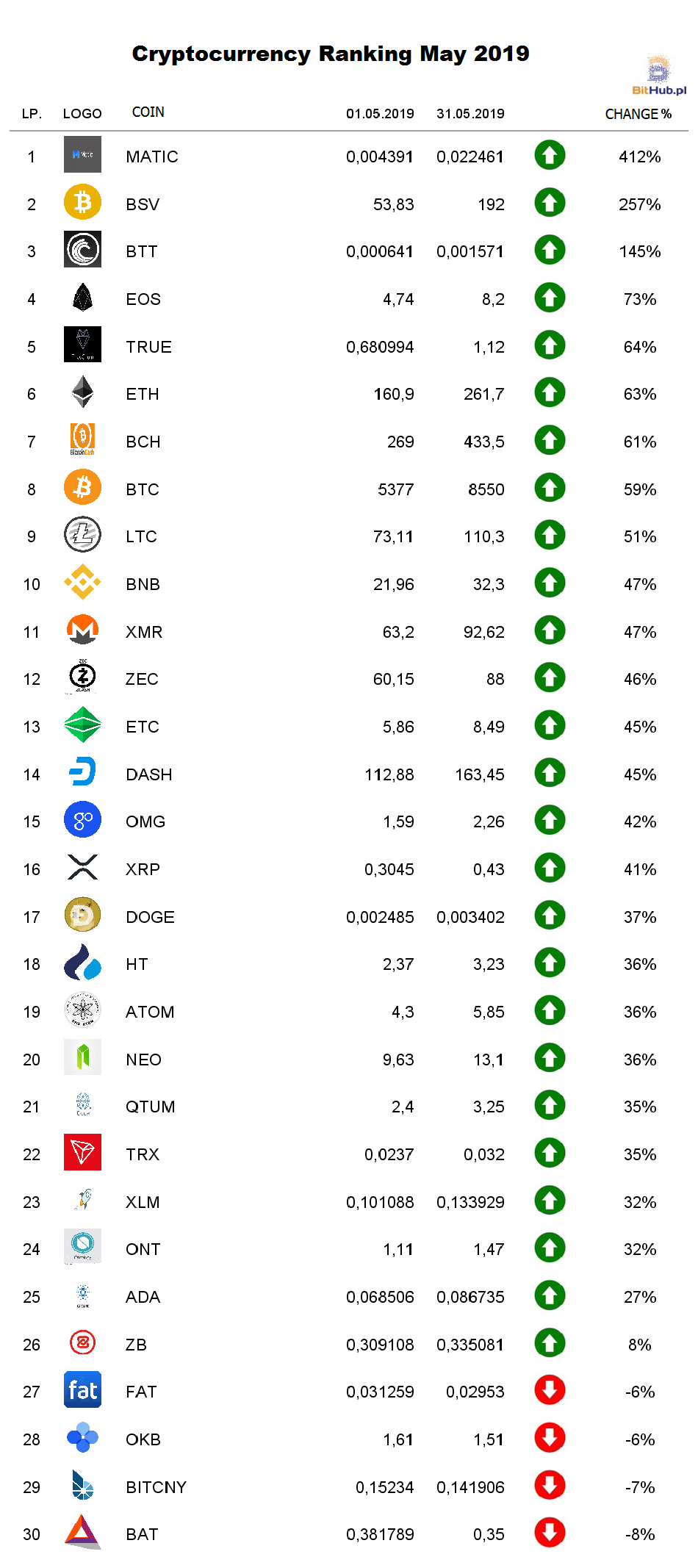

Cryptocurrency Ranking May 2019

The mood on the cryptocurrency market in May was even better than in April. Currently, we can be sure that crypto winter is gone and the bottom of the Bitcoin’s price was settled around $3500. Shall we be preparing fo the next ATH (All-Time High)? Or maybe BTC’s rate of exchange will be more stable? We will soon find out and now we are presenting the Cryptocurrency Ranking May 2019.

In the February edition of Bithub’s Cryptocurrency Ranking we used for the first time a new method of selecting 30 coins. It is based on 30-day volume. Our new method allows us to examine the most „popular” projects in each month, which cannot be determined by looking at their marketcaps. What is more, the Ranking’s structure will not be pernament – it will gain the possibility of including different coins every month. For this purpose we use data from coinmarketcap. As every month, we present ROI of 30 digital curriencies exluding stablecoins.

List of 30 cryptocurrencies with highest volume in May and their marketcap

| Cryptocurrency | Volume (30-day) | Marketcap |

| Bitcoin | $670 453 194 048 | $151 069 829 136 |

| Ethereum | $290 688 963 587 | $27 901 471 906 |

| Litecoin | $115 517 224 011 | $6 954 532 366 |

| EOS | $83 646 357 287 | $7 548 295 872 |

| Bitcoin Cash | $74 426 128 802 | $7 813 044 463 |

| Ripple | $62 641 164 330 | $18 305 236 103 |

| TRON | $24 136 148 924 | $2 161 628 308 |

| Ethereum Classic | $18 714 712 007 | $937 610 028 |

| ZCASH | $12 698 586 524 | $598 509 317 |

| NEO | $12 679 301 636 | $862 320 056 |

| DASH | $12 190 895 310 | $1 437 798 193 |

| Stellar | $11 768 175 922 | $2 548 458 539 |

| Binance Coin | $11 502 072 614 | $4 575 170 401 |

| Bitcoin SV | $9 927 472 472 | $3 393 540 872 |

| bitCNY | $8 289 513 518 | $10 892 729 |

| Qtum | $6 031 046 708 | $314 108 716 |

| BitTorrent | $3 929 711 169 | $330 575 166 |

| Cardano | $3 626 060 550 | $2 280 136 412 |

| MATIC | $3 226 002 992 | $48 897 803 |

| Huobi Token | $3 112 413 408 | $161 948 733 |

| Ontology | $3 091 386 690 | $730 700 764 |

| Fatcoin | $2 852 463 625 | – |

| OmiseGO | $2 850 317 169 | $315 546 717 |

| OKB | $2 743 218 319 | – |

|

Monero |

$2 617 235 788 | $1 584 895 926 |

| Cosmos | $2 301 763 539 | $1 124 228 199 |

| ZB | $1 785 915 375 | – |

| BAT | $1 630 437 224 | $439 372 406 |

| TrueChain | $1 601 598 428 | $89 147 541 |

| Dogecoin | $1 552 327 716 | $405 341 894 |

BTC’s price

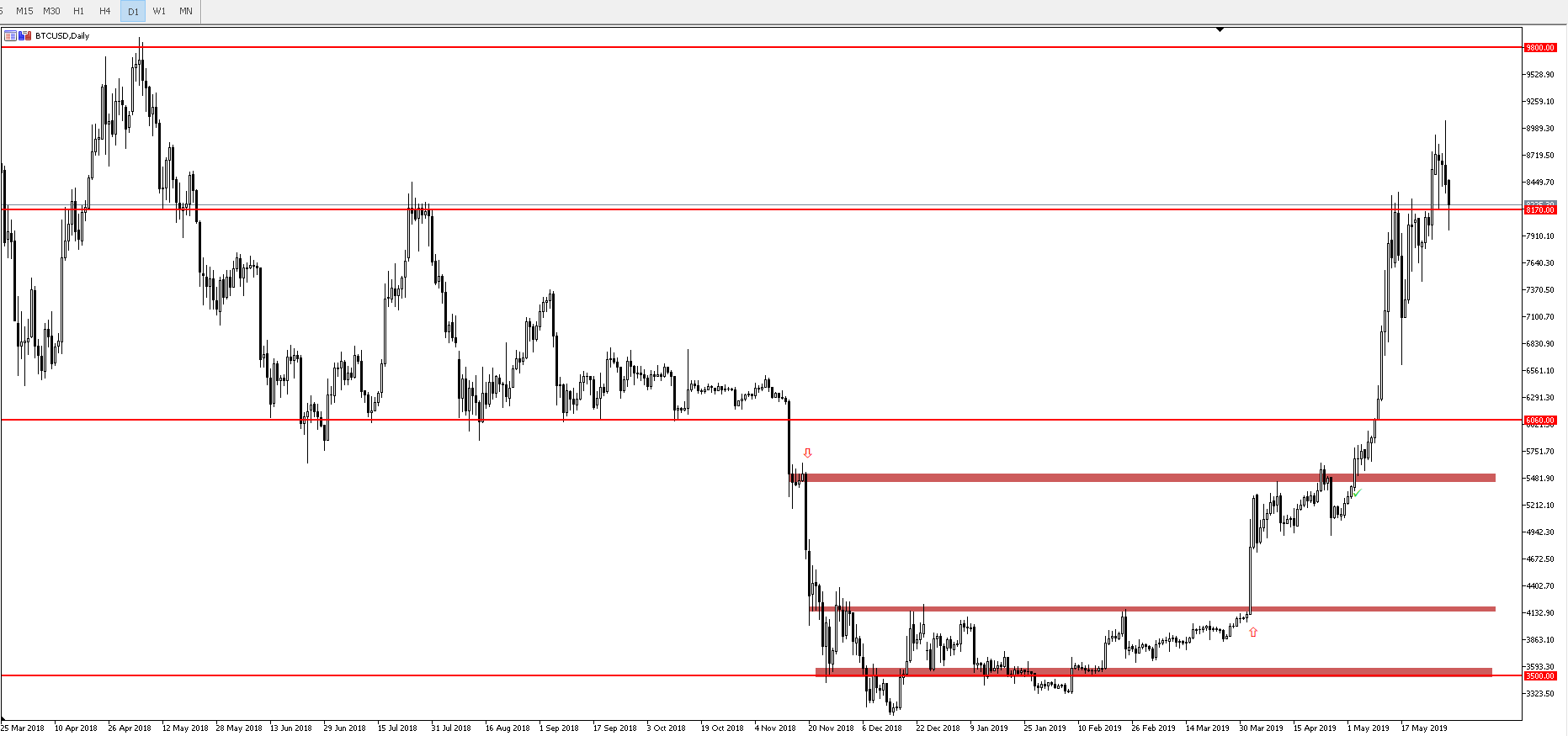

At the beginnig of the month, Bitcoin’s price was above 5300$. Then, it started to increase and on the 12th of May it surged to $7450. After that, there was a slight correction to the level of $7000, but BTC’s price bounced immediately to $8000. On 17th of May we came back again to $7000, but three day later it was already above $8000. It oscillated in this region until 26th of May, when it rose rapidly to $8800. It stayed there for two days and then decreased to $8400.

Total Market Capitalization

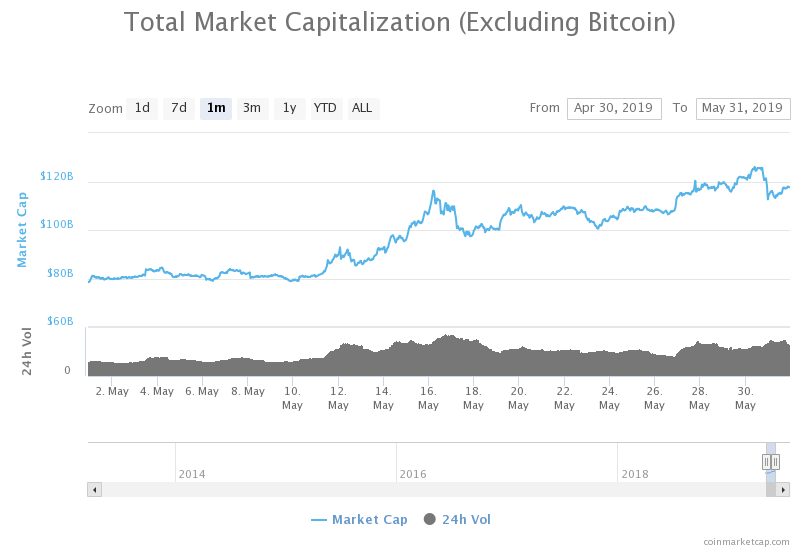

Total Total Market Capitalization (exluding Bitcoin)

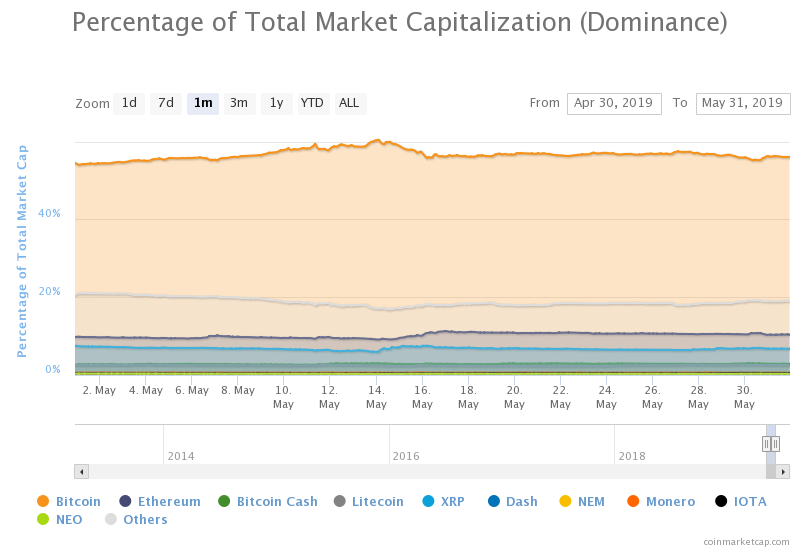

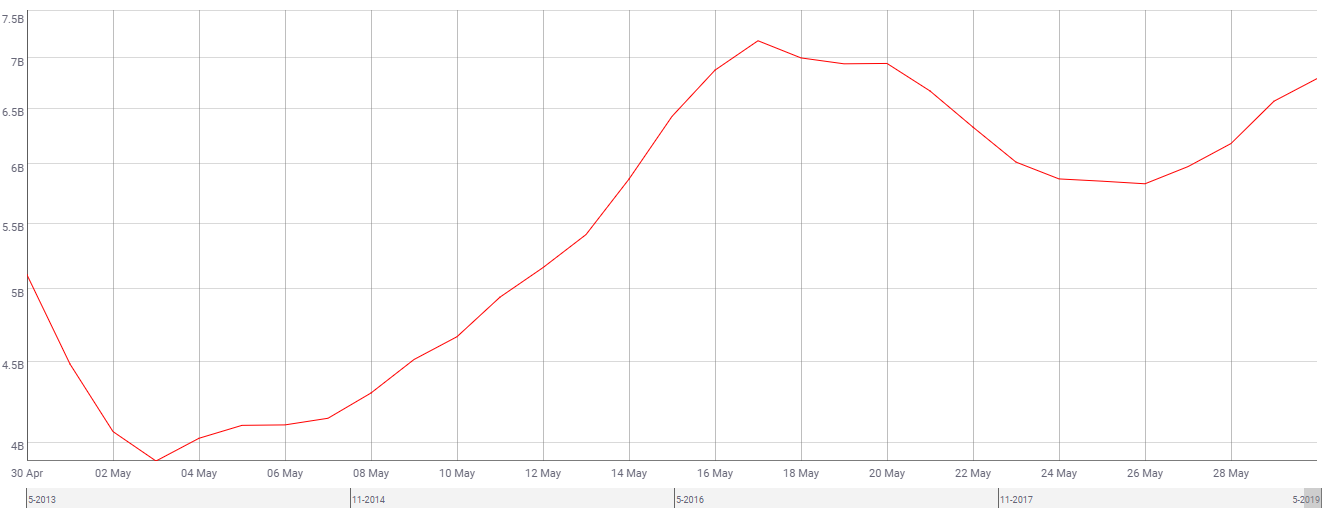

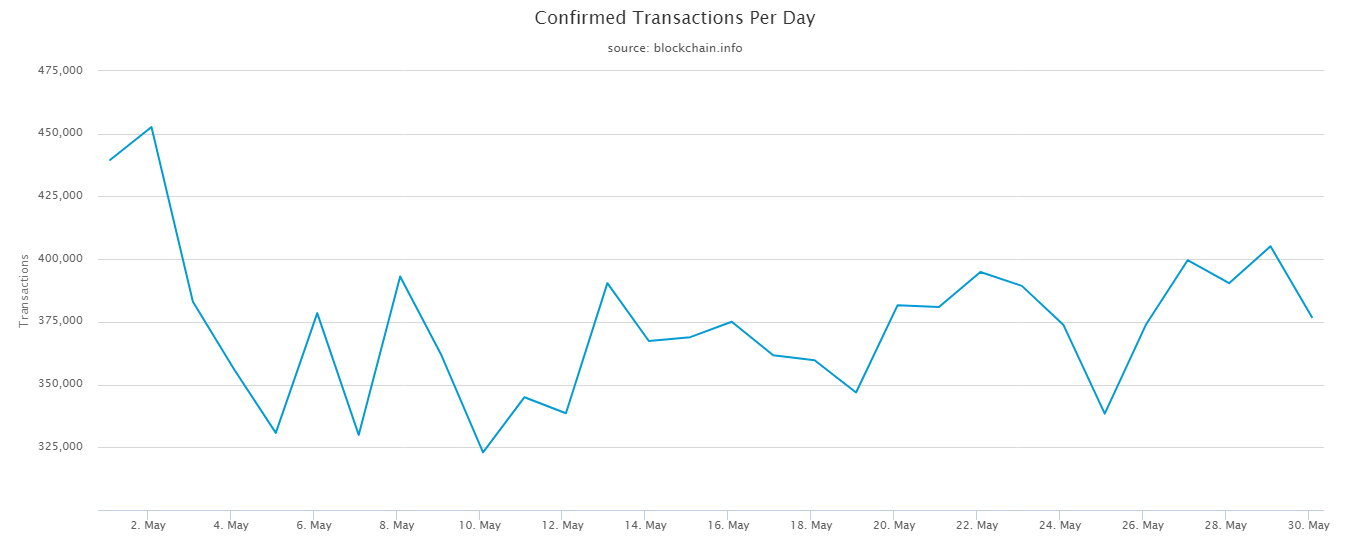

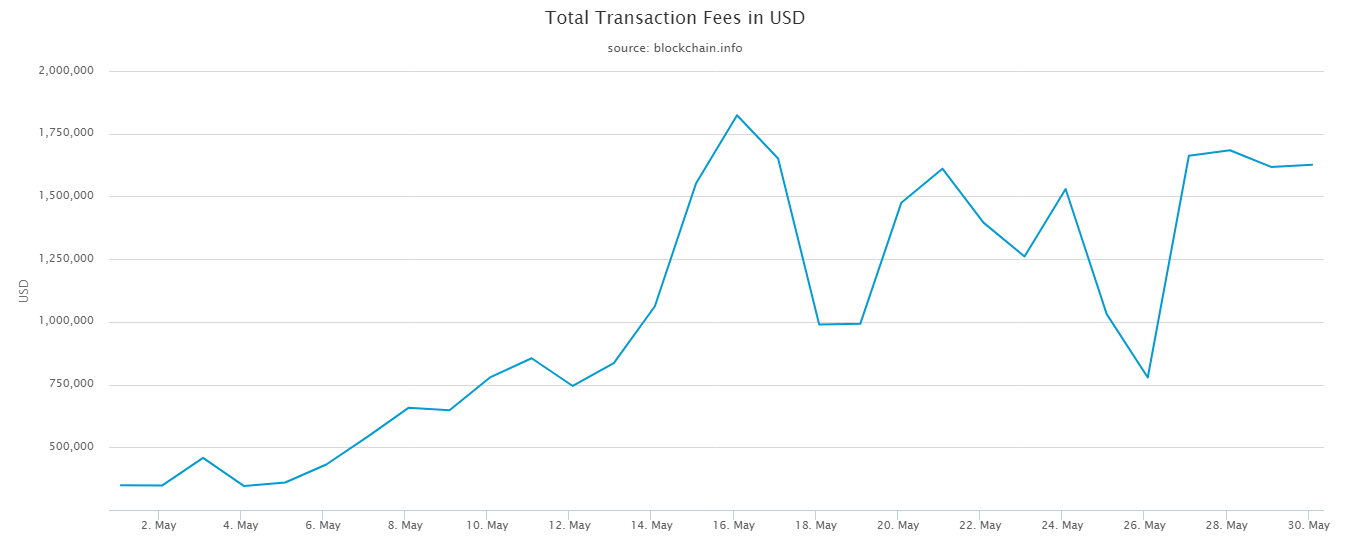

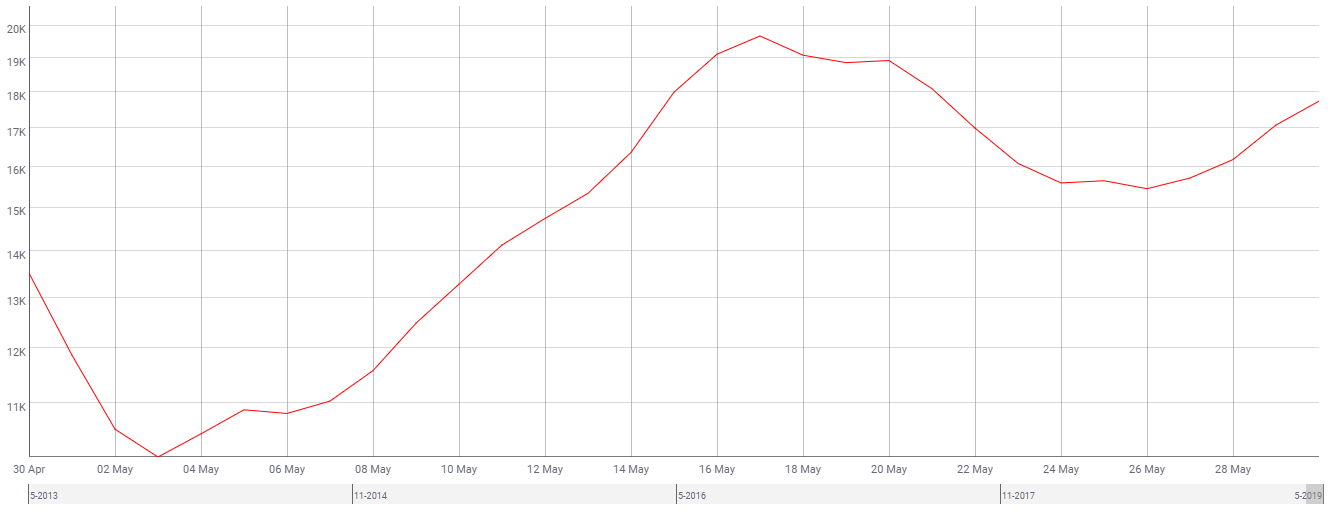

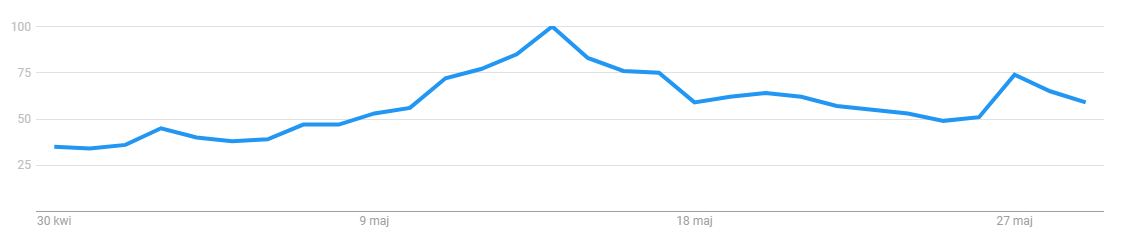

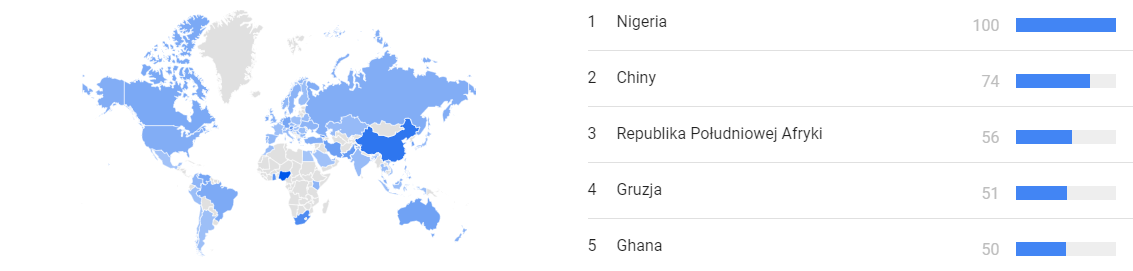

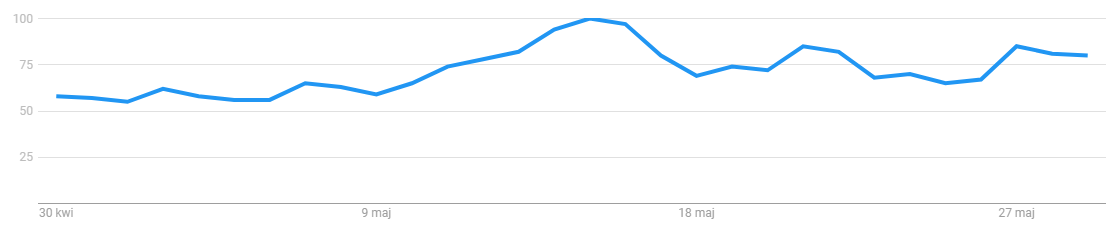

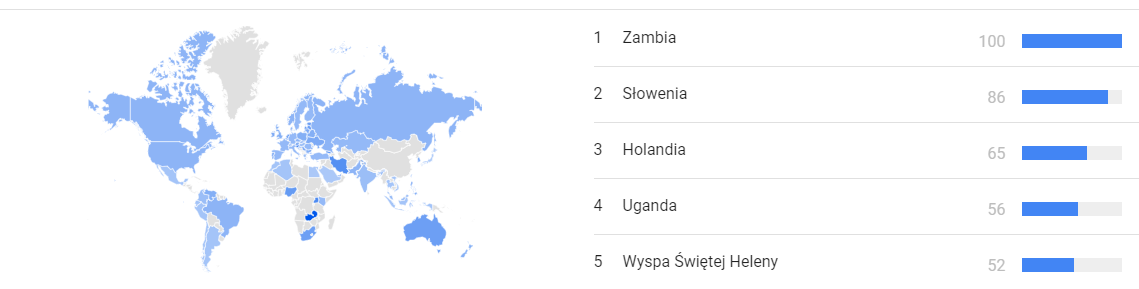

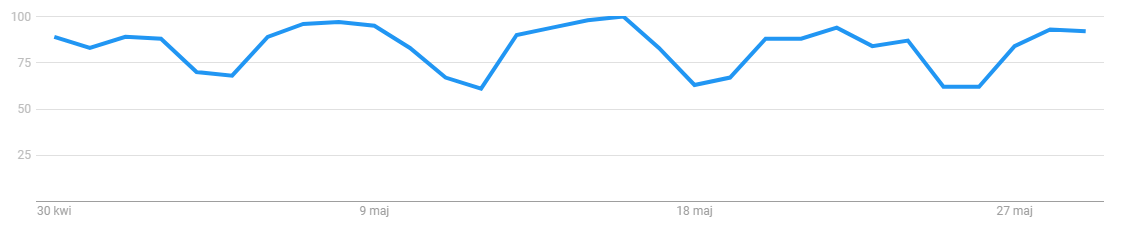

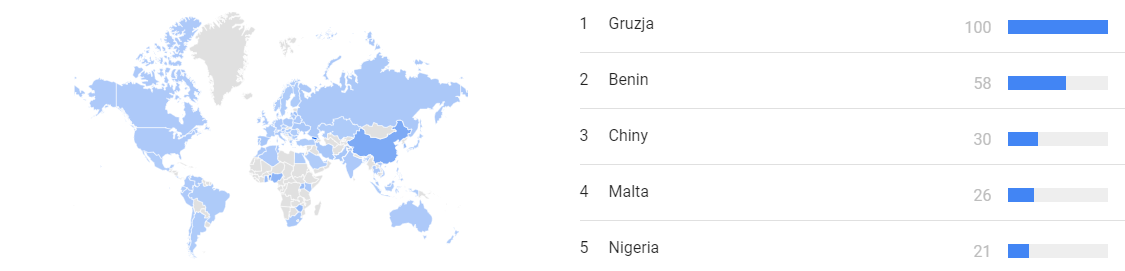

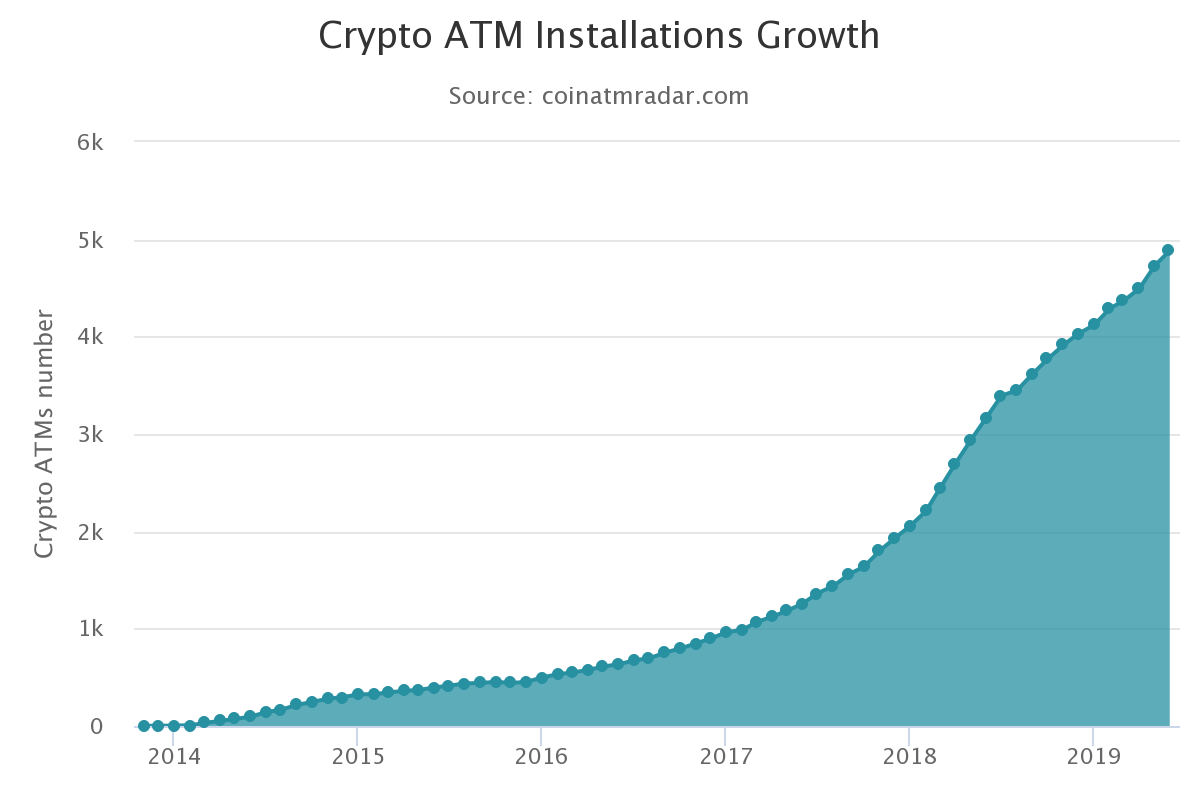

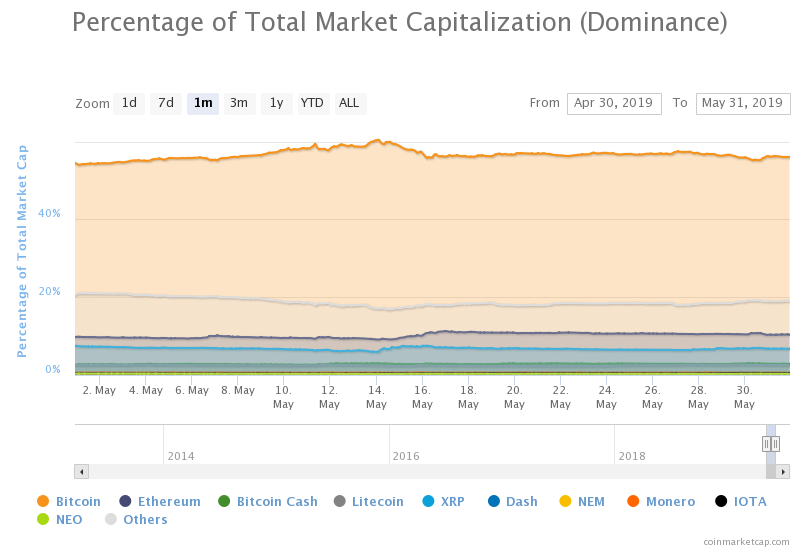

Percentage of Bitcoin’s total market capitalization (dominance) increased again – from 54,53% to 56,08%. Standard deviation of daily returns (Bitcoin’s Volatility) increased from 3,8% to around 4,2%. At the beginning of the month, Bitcoin’s transaction volume fell from 5B to lower than 4B. Then, it increased to 7B until 16th of May. After that, it decreased to 6B until 26th of May and closed the month under 6B. At the beginning of May, the number of Bitcoin’s Confirmed Transactions Per Day decreased from 450k to 325k. Then, tt oscillated between 325k and 400k to the end of the month. If we take values from the beginning and the end of the month into account, total transactions fees increased six times during May. At the beginning of the month, Bitcoin’s Average Transaction Value decreased from $13,5k to $10k. Then, there was a strong increase to $19,3k, but on the 17th of May it started to decrease. At the end of the month it was at the level of $18k. According to Google Scholar, 367 scientific papers related to Bitcoin were published in May – it is exactly 119 more than in April. Phrase „Litecoin” can be found in 9 articles (4 less than in March), „Ethereum” – in 125 articles (49 more than in last month), „Bitcoin Cash” – only in two articles. Number of „Bitcoin” phrase searches started to rise on 8th of May – it was because of rapid increase of its price. Then, the general interest fell and stayed around 55 points. As far as geography factors are concerned, „Bitcoin” phrase was the most popular in Nigeria again. Next positions were respectively occupied by China, RPA, Georgia and Ghana. As we can see, Saint Helena Island fell out from the first fifth. General interest in „cryptocurrency” phrase was similiar to „Bitcoin” phrase. At the beginning of the month it stayed at around 60 points and then it rose together with BTC’s price. After that, it fell to 75 points level and oscillated around that value to the end of May. This time, „cryptocurrency” phrase was searched most often in Zambia. Slovenia took the second place again, with 86 points. Third, fourth and fifth were Netherlands, Uganda and Saint Helena Island. „Blockchain” phrase was the most popular in Georgia for the second time in a row. Surprisingly, Benin turned up at next position, but it was 42 points behind the leader. On the third, fourth and fifth place we can see respectively China, Malta and Nigeria. For the first time, South Korea and Saint Helena Island left the first fifth. There were 4884 Bitcoin ATM’s all over the world at the end of May. It is 179 more than at the end of April. Bitcoin ATM industry is thriving because of rising popularity in South America, especially in Venezuela and Columbia. Citizens of countries that are in bad economic shape (usually developing countries) are looking for alternatives to FIAT money and often decide to use cryptocurrencies. Bitcoin ATMs are the easiest way for many people to buy them. This results in increased adoption of Bitcoin and makes it closer to the wider public. What is more, Bitcoin ATMs give a possibility to avoid high taxes. The May has come and it brought increases on the cryptocurrency market. Total market capitalization rose to $264B. Rising prices and total market capitalization did not have an impact on Bitcoin dominance. It oscillated in the 55-60% range. BTC’s price started it rally from the level of $5300 and got to $8200 (at the time this comment was being written). First barrier was resistance at $8200. Bitcoin’s rate overcame it and now it is being tested as support for further increases. Next target is around $9800. Crypto market in May was very fruitful. BTC’s exchange rate was the highest since 2018, major exchanges had highest 24h volumes. It is an obvious sign, that cryptocurriencies are more mainstream than in last years. Total market capitalization significantly increased. In my opinion, this boom is caused by trade war between China and USA. Last days of the month knocked us a little bit out of the rhythm. Everyone expects, that BTC’s price would rise endlessly. Unfortunately, now we can be stuck in lateral movement for a while. Alternatively, there will a correction, test of the support and then we fly again.

Bitcoin’ Market Dominance

Bitcoin’s Volatility (30-Day)

Bitcoin’s Transaction Volume

Bitcoin’s Confirmed Transactions Per Day

Total Transactions Fees

Bitcoin’s Average Transaction Value

Google Scholar – number of articles related to cryptocurrencies

Google Trends – crypto phrases

Number of Bitcoin ATMs

Comments

JPK Traders:

Nikodem Nawrocki: