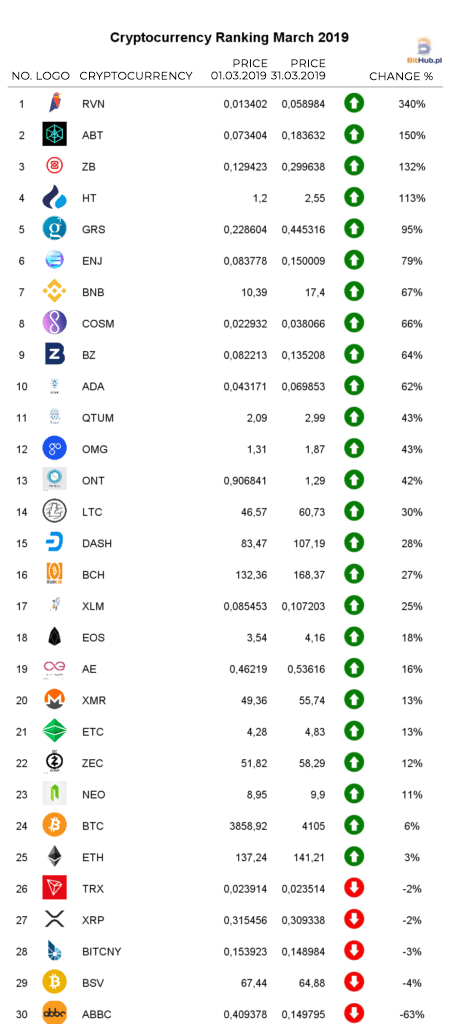

Cryptocurrency Ranking March 2019

Another month passed and it seems that winter is gone – as far as weather is concerned as well as cryptocurrency market. We can see many signs of recovery, but we all should be aware of crypto market’s high volatility – nothing is impossible. Market outlook can be very accurate if it includes different scenerios: we cannot be sure, who is going to rule the market – bulls or bears? There is also third option, which means, that none of them will dominate. Which scenario will be closer to the truth?

In the February edition of Bithub’s Cryptocurrency Ranking we used for the first time a new method of selecting 30 coins. It is based on 30-day volume. Our new method allows us to examine the most „popular” projects in each month, which cannot be determined by looking at their marketcaps. What is more, the Ranking’s structure will not be pernament – it will gain the possibility of including different coins every month. For this purpose we use data from coinmarketcap. As every month, we present ROI of 30 digital curriencies exluding stablecoins.

List of 30 cryptocurrencies with highest volume in February and their marketcap

| Cryptocurrency | Volume (30-day) | Marketcap |

| Bitcoin | $278 557 021 874 | $72 354 896 293 |

| Ethereum | $129 681 580 510 | $14 911 723 549 |

| Litecoin | $52 565 010 709 | $3 706 703 512 |

| EOS | $48 548 312 259 | $3 787 566 706 |

| Ripple | $20 450 216 017 | $12 912 915 670 |

| Bitcoin Cash | $11 377 389 515 | $2 975 678 753 |

| NEO | $8 400 812 012 | $634 688 834 |

| Qtum | $7 955 104 054 | $253 571 545 |

| DASH | $7 523 583 270 | $906 672 332 |

| Ethereum Classic | $6 383 913 095 | $526 368 402 |

| Stellar | $5 781 094 857 | $2 058 353 682 |

| Zcash | $5 480 578 666 | $357 604 837 |

| TRON | $5 384 520 120 | $1 556 314 346 |

| Binance Coin | $4 909 274 815 | $2 433 043 769 |

| Bitcoin SV | $2 831 697 231 | $1 143 910 600 |

| Monero | $2 461 404 785 | $911 865 578 |

| Huobi Token | $2 461 404 785 | $126 183 064 |

| Ontology | $1 980 841 020 | $632 773 633 |

| bitCNY | $1 912 964 348 | $8 579 938 |

| OmiseGO | $1 885 396 154 | $261 685 121 |

| Aeternity | $1 614 822 551 | $136 908 686 |

| Cardano | $1 608 571 700 | $1 833 204 881 |

| Cosmo Coin | $1 593 428 937 | 25 055 560 |

| Enjin Coin | $1 186 159 021 | $115 975 849 |

| Ravencoin | $1 177 200 778 | $190 846 298 |

| ZB | $1 124 828 790 | – |

| ABBC Coin | $1 091 500 149 | $67 984 339 |

| Bit-Z Token | $1 081 497 151 | $5 780 307 |

| Arcblock | $1 067 107 723 | $18 900 155 |

| Groestlcoin | $1 013 882 492 | $31 786 088 |

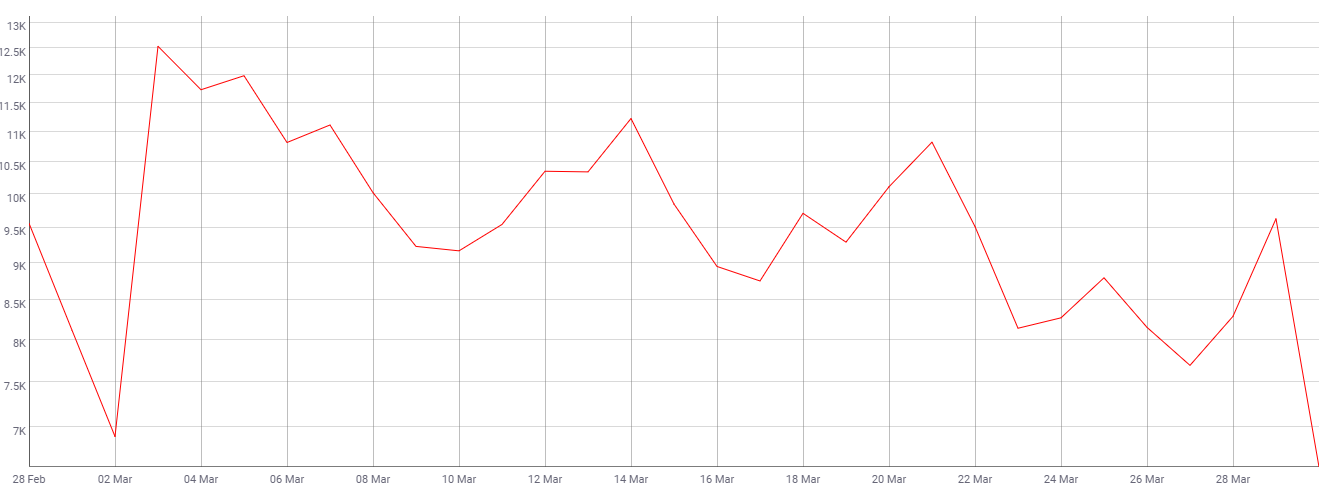

BTC’s price

At the beginnig of the month, Bitcoin’s price oscillated between 3850$ and 3900$. Then, on 4th of March, it decreased to 3760$, but did not stay there for a long time – next day it started to rise. On 16th it broke through 4000$ level and stayed above it until 25th of March, when it decrased to 3950$ for a short period of time. Right after that it surged to 4100$. At the and of the month it tested resistance at 4200$, but it did not make it and came back to 4100$ level.

Total Market Capitalization

Total market capitalization reflects BTC’s trend. When Bitcoin is doing well, other digital curriencies benefit from that. Their gains are often two or three times higher than Bitcoin’s.

Total Market Capitalization (exluding Bitcoin)

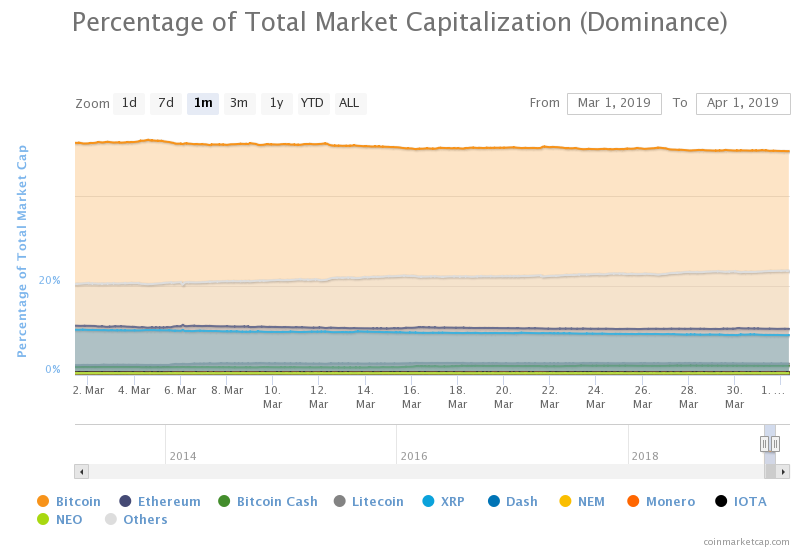

Bitcoin’ Market Dominance

Percentage of Bitcoin’s total market capitalization (dominance) slightly decreased in March – from 51,89% to 50,12%. Bitcoin’s dominance usually rises during downtrend.

Bitcoin’s Volatility (30-Day)

Standard deviation of daily returns (Bitcoin’s Volatility) decreased from 2,86% to around 1,33% – nearly two times.

Bitcoin’s Transaction Volume

At the beginning of the month, Bitcoin’s transaction volume fell from 3,5B to around 2,3B. Then it oscillated between 2B and 3,4B for a week. On the 24th of March it decreased to around 1,9B and reached around 3,2B by the end of the month.

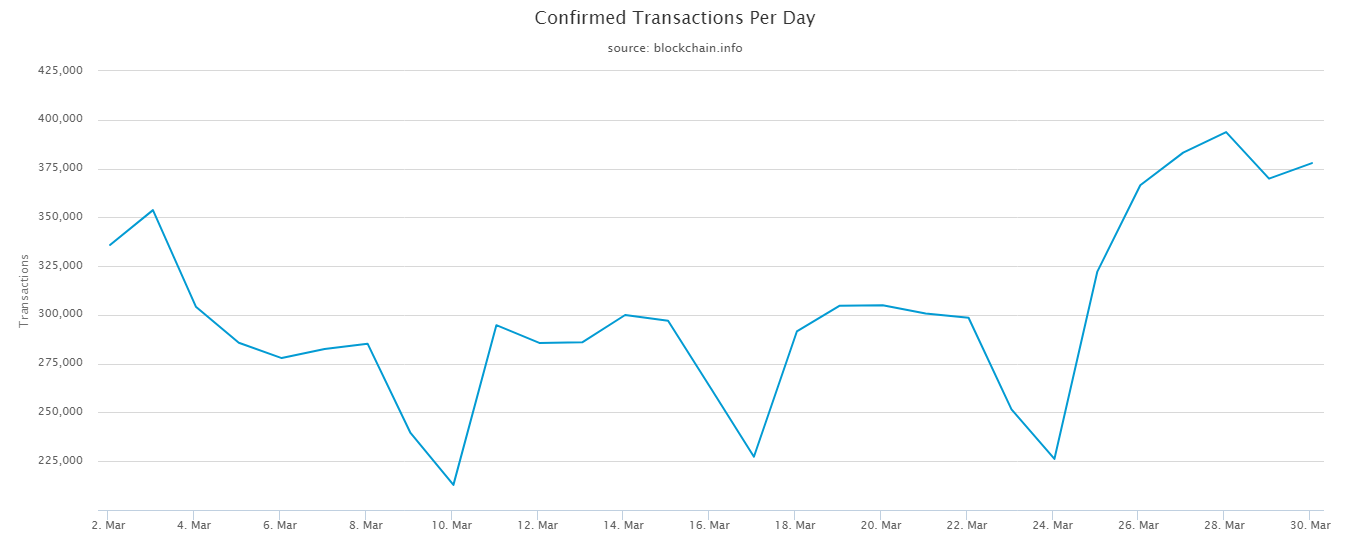

Bitcoin’s Confirmed Transactions Per Day

Until 24th of March, the number of Bitcoin’s Confirmed Transactions Per Day oscillated between 220k and 350k. Then it increased and reached around 375k at the end of the month.

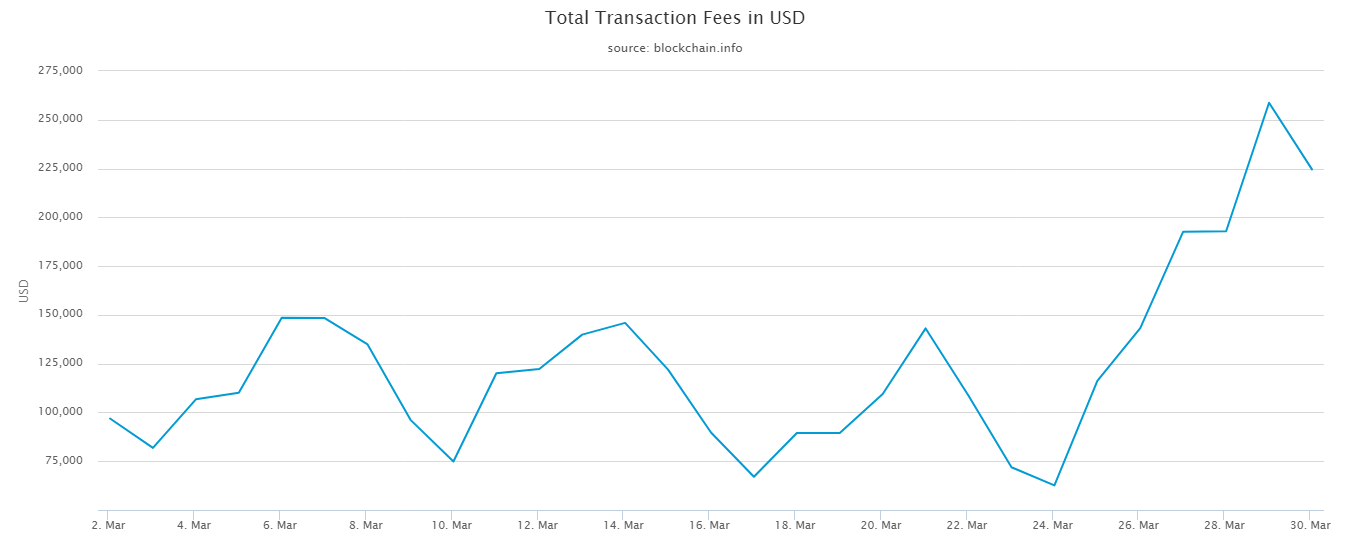

Total Transactions Fees

Total transactions fees increased nearly four times.

Bitcoin’s Average Transaction Value

Bitcoin’s Average Transaction Value decreased during March and it was less than 7k at the end of the month.

Google Scholar – number of articles related to cryptocurrencies

According to Google Scholar, 992 scientific papers related to Bitcoin were published in March – it is 24 more than in February. Phrase „Litecoin” can be found in 139 articles (two less than in January), „Ethereum” – in 563 articles (102 more than in last month), „Bitcoin Cash” – in 60 articles (13 less than in February).

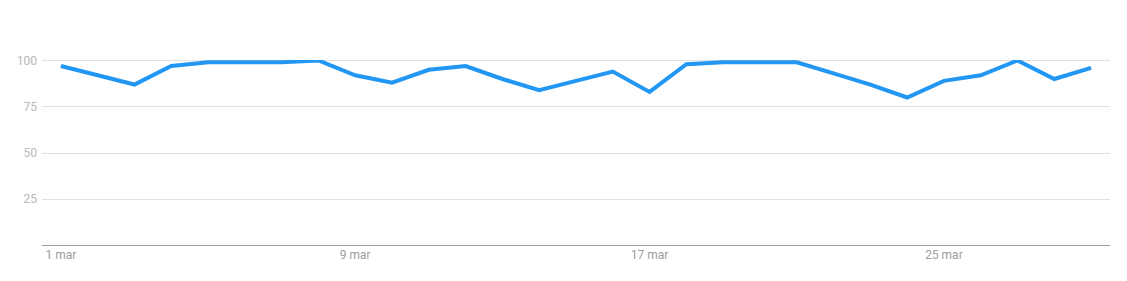

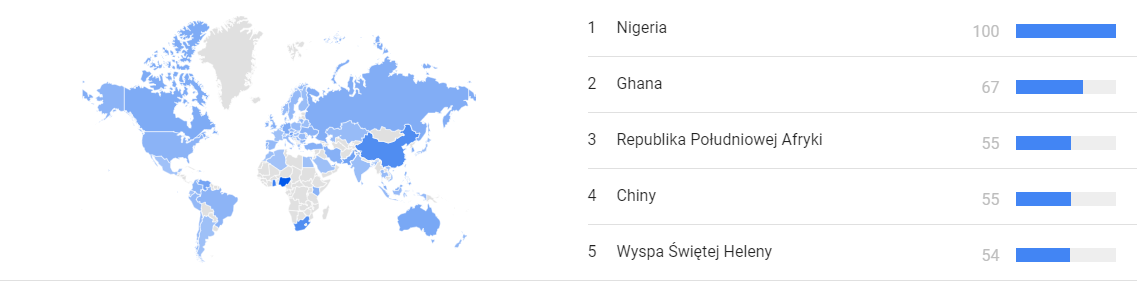

Google Trends – crypto phrases

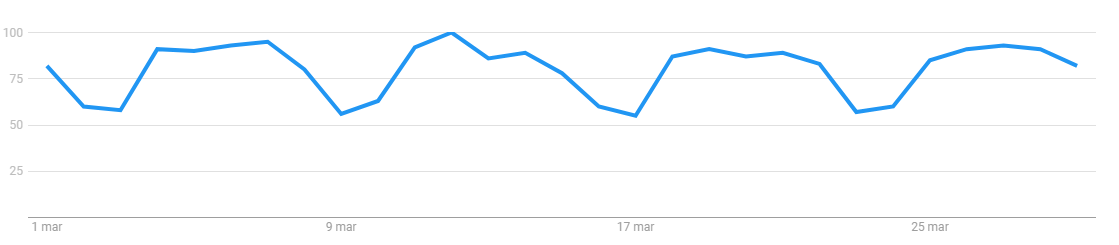

- Bitcoin

Number of „Bitcoin” phrase searches was stable during last month – it fluctuated between 80 and 100 points. It reached highest values in the beginning and at the end of March. Bitcoin” phrase was the most popular in Nigeria. The next positions were respectively occupied by Ghana, RPA, China and Saint Helena Island.

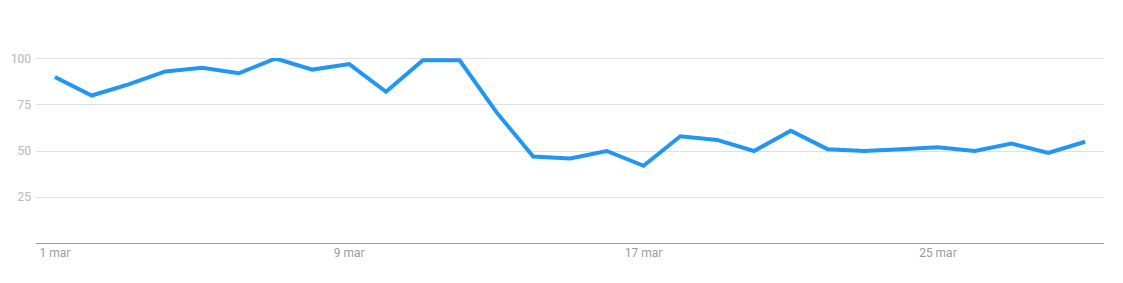

- Cryptocurrency

This time, „cryptocurrency” phrase was searched most often on Saint Helena Island and Slovenia took the second place, being 25 points from the first place. Third, fourth and fifth were Estonia, China and Netherlands.

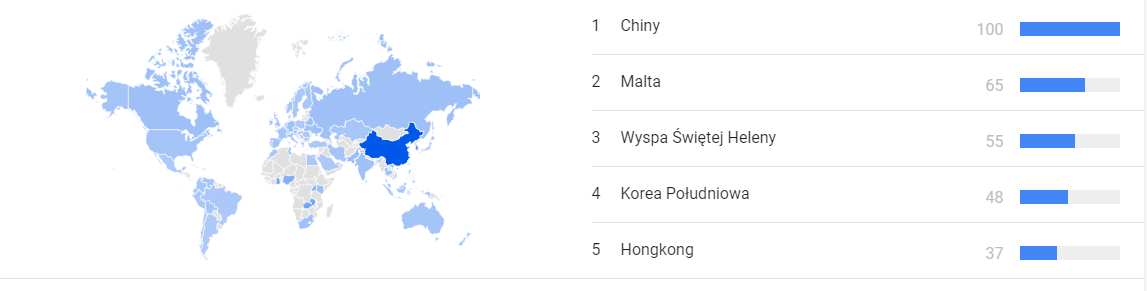

- blockchain

„Blockchain” phrase was the most popular in China. Malta took the second position, but it was rather far from the first place. On the third, foyrth and fifth place we can see respectively Saint Helena Island, South Korea and Hongkong.

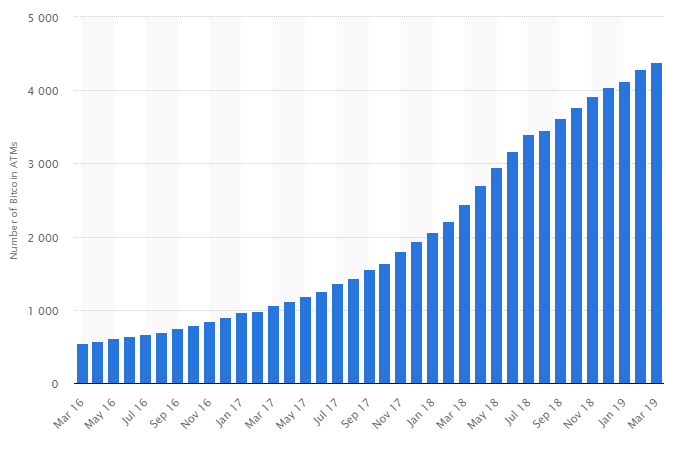

Number of Bitcoin ATMs

There were 4387 Bitcoin ATM’s all over the world at the end of March. It is 92 more than at the end of January. Bitcoin ATM industry is thriving because of rising popularity in South America, especially in Venezuela and Columbia. Citizens of countries that are in bad economic shape (usually developing countries) are looking for alternatives to FIAT money and often decide to use cryptocurrencies. Bitcoin ATMs are the easiest way for many people to buy them. This results in increased adoption of Bitcoin and makes it closer to the wider public.

Comments

Daniel Draganov

Bitcoin had an amazing couple of bullish weeks, marking higher lows and making higher highs. Since the late December rally the volume has been in steady decline, while the price was going upwards. What I think is happening right now is that the current trend is coming to an end. The lack of volume indicates that currently there is not a lot of activity in the market and Bitcoin is in a „No man’s land”, between the bulls and the bears. The historical volatility is at ATL which means that there will be a massive move in any direction soon.

On the other hand, the altcoin market is in a very interesting state. The volume is rising and a lot of coins are making a significant price increase (some of them are even making new all time high). The Bitcoin dominance is looking like it will fall soon, which can give space to the alts to pump.